The Buzz on Insurance Meaning

Wiki Article

The Of Insurance And Investment

Table of ContentsInsurance And Investment Fundamentals ExplainedInsurance Code for BeginnersLittle Known Questions About Insurance Asia Awards.The 4-Minute Rule for Insurance AgentFacts About Insurance Meaning Uncovered6 Simple Techniques For Insurance Advisor

Insurance coverage provides comfort against the unexpected. You can discover a plan to cover nearly anything, but some are a lot more important than others. It all depends on your needs. As you map out your future, these 4 kinds of insurance policy must be securely on your radar. 1. Automobile Insurance coverage Automobile insurance is critical if you drive.Some states likewise require you to lug accident protection (PIP) and/or uninsured driver insurance coverage. These insurance coverages spend for medical expenditures associated with the case for you and your travelers, despite that is at mistake. This additionally assists cover hit-and-run accidents as well as accidents with chauffeurs that don't have insurance coverage.

This may come at a higher price as well as with less coverage. That's since it shields you versus costs for property damage.

Indicators on Insurance Asia Awards You Should Know

In case of a theft, fire, or catastrophe, your tenant's policy should cover a lot of the costs. It may additionally help you pay if you have to remain somewhere else while your residence is being repaired. And also, like home insurance policy, occupants supplies obligation defense. 3. Wellness Insurance coverage Wellness insurance policy is among the most crucial types.

What Does Insurance Meaning Mean?

You Might Want Impairment Insurance Policy Too "Unlike what lots of people believe, their residence or car is not their greatest possession. Instead, it is their capability to earn a revenue. Lots of experts do not guarantee the chance of a disability," claimed John Barnes, CFP as well as owner of My Household Life Insurance Policy, in an email to The Balance.You should additionally think about your needs. Talk with accredited agents to discover the most effective methods to make these plans help you. Financial coordinators can give guidance about other typical types of insurance policy that ought to likewise belong to your economic plan.

Health Insurance coverage What does it cover? Medical insurance covers your needed medical prices, from medical professional's consultations to surgical treatments. Along with coverage for health problems as well as injuries, wellness insurance coverage covers preventative care, such as monthly check-ins and examinations. Do you need it? Medical insurance is perhaps one of the most crucial sort of insurance policy.

Insurance Expense Things To Know Before You Buy

You possibly don't require it if Every grownup ought to have medical insurance. Children are usually covered under among their parents' strategies. 2. Cars and read more truck Insurance policy What does it cover? There are several different sorts of automobile insurance that cover various scenarios, consisting of: Responsibility: Liability insurance comes in two forms: bodily injury as well as residential property damages obligation.Individual Injury Protection: This type of protection will certainly cover medical expenses related to motorist and guest injuries. Collision: Accident insurance policy will cover the cost of the damages to your automobile if you obtain into a crash, whether you're at mistake insurance excess meaning or not. Comprehensive: Whereas crash insurance policy just covers damages to your car triggered by an accident, thorough insurance coverage covers any type of car-related damages, whether it's a tree dropping on your automobile or criminal damage from unmanageable community children, for instance.

There are plenty of price cuts you may be eligible for to reduce your month-to-month bill, including risk-free motorist, wed vehicle driver, and also multi-car discounts. Do you require it? Every state needs you to have automobile insurance policy if you're going to drive an automobile.

Get This Report about Insurance Companies

You most likely do not need it if If you don't own a lorry or have a chauffeur's license, you will not need car insurance policy. Home Owners or Renters Insurance Policy What does it cover?You might require additional insurance to try this site cover natural disasters, like flooding, earthquakes, and also wildfires. Tenants insurance covers you against damage or burglary of personal items in an apartment, as well as in some cases, your car. It also covers responsibility prices if someone was injured in your apartment or if their belongings were harmed or stolen from your apartment or condo.

Not just is your house covered, yet most of your valuables and individual items are covered. Renters insurance coverage isn't as essential, unless you have a large home that has lots of prized possessions.

9 Easy Facts About Insurance Expense Explained

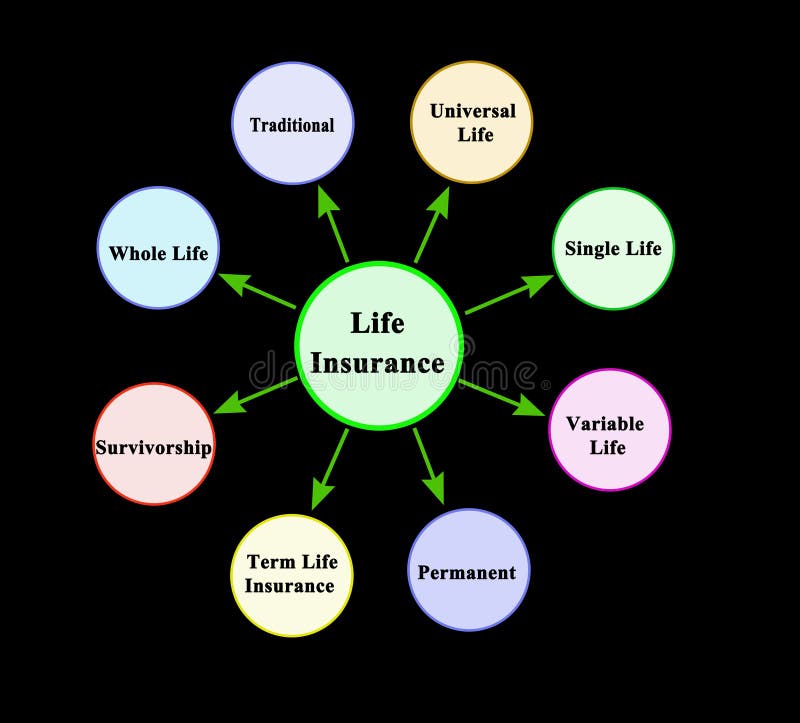

Do you require it? Life insurance policy is the kind of insurance coverage that the majority of people desire to prevent assuming about. It's unbelievably vital. If you have a family members, you likewise have an obligation to make certain they're offered in the event that you pass before your time, particularly if you have kids or if you have a spouse that's not working.

Report this wiki page